Discussion

Home ‣ Logical Reasoning ‣ Statement and Argument See What Others Are Saying!

- Question

Statement: Should the income generated out of agricultural activities be taxed?

Arguments:

- No. Farmers are otherwise suffering from natural calamities and low yield coupled with low procurement price and their income should not be taxed.

- Yes. Majority of the population is dependent on agriculture and hence their income should be taxed to augment the resources.

- Yes. Many big farmers earn much more than the majority of the service earners and they should be taxed to remove the disparity.

Options- A. Only I is strong

- B. Only I and II are strong

- C. Only II and III are strong

- D. All are strong

- E. None of these

- Correct Answer

- Only II and III are strong

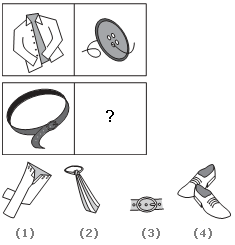

ExplanationClearly, if the income of farmers is not adequate, they cannot be brought under the net of taxation as per rules governing the Income Tax Act. So, I is not strong. Besides, a major part of the population is dependent on agriculture and such a large section, if taxed even with certain concessions, would draw in huge funds, into the government coffers. Also, many big landlords with substantially high incomes from agriculture are taking undue advantage of this benefit. So, both arguments II and III hold strong. - 1. Choose the picture that would go in the empty box so that the two bottom pictures are related in the same way as the top two:

Options- A. 1

- B. 2

- C. 3

- D. 4 Discuss

- 2. Which word does NOT belong with the others?

Options- A. couch

- B. rug

- C. table

- D. chair Discuss

- 3. Which word does NOT belong with the others?

Options- A. eel

- B. lobster

- C. crab

- D. shrimp Discuss

- 4. 14 14 26 26 38 38 50

Options- A. 60 72

- B. 50 62

- C. 50 72

- D. 62 62

- E. 62 80 Discuss

- 5. All guilty politicians were arrested. Kishan and Chander were among those arrested.

Options- A. All politicians are guilty.

- B. All arrested people are politicians.

- C. Kishan and Chander were not politicians.

- D. Kishan and Chander were guilty. Discuss

- 6. Statement: Is caste-based reservation policy in professional colleges justified?

Arguments:

- Yes. The step is a must to bring the underprivileged at par with the privileged ones.

- No. It obstructs the establishment of a classless society.

- Yes. This will help the backward castes and classes of people to come out of the oppression of upper caste people.

Options- A. Only I and II are strong

- B. Only II is strong

- C. Only II and III are strong

- D. Only I and III are strong

- E. All are strong Discuss

- 7. Statement: 'Guests should be provided lunch.' - A tells B.

Assumptions:

- Unless told, lunch may not be provided.

- Guests will stay during lunch time.

Options- A. Only assumption I is implicit

- B. Only assumption II is implicit

- C. Either I or II is implicit

- D. Neither I nor II is implicit

- E. Both I and II are implicit Discuss

- 8. Which word does NOT belong with the others?

Options- A. dodge

- B. flee

- C. duck

- D. avoid Discuss

- 9. Statement: Should agriculture in rural India be mechanized?

Arguments:

- Yes. It would lead to higher production.

- No. Many villagers would be left unemployed.

Options- A. Only argument I is strong

- B. Only argument II is strong

- C. Either I or II is strong

- D. Neither I nor II is strong

- E. Both I and II are strong Discuss

- 10. 28 25 5 21 18 5 14

Options- A. 11 5

- B. 10 7

- C. 11 8

- D. 5 10

- E. 10 5 Discuss

More questions

Correct Answer: 3

Explanation:

A shirt is to a button as a belt is to a belt buckle. A button is used to close a shirt; a belt buckle is used to close a belt.

Correct Answer: rug

Explanation:

The couch, table, and chair are pieces of furniture; the rug is not.

Correct Answer: eel

Explanation:

The lobster, crab, and shrimp are all types of crustaceans; an eel is a fish.

Correct Answer: 50 62

Explanation:

In this simple addition with repetition series, each number in the series repeats itself, and then increases by 12 to arrive at the next number.

Correct Answer: Kishan and Chander were guilty.

Correct Answer: Only II is strong

Explanation:

Clearly, capability is an essential criteria for a profession and reservation cannot ensure capable workers. So, neither I nor III holds strong. However, making one caste more privileged than the other through reservations would hinder the objectives of a classless society. So, argument II holds strong.

Correct Answer: Both I and II are implicit

Explanation:

Since both I and II follow from the statement, so both are implicit.

Correct Answer: flee

Explanation:

Dodge, duck, and avoid are all synonyms meaning evade. Flee means to run away from.

Correct Answer: Only argument I is strong

Explanation:

Clearly, mechanization would speed up the work and increase the production. So, argument I is strong enough. Argument II is vague because mechanization will only eliminate wasteful employment, not create unemployment.

Correct Answer: 11 5

Explanation:

This is an alternating subtraction series with the interpolation of a random number, 5, as every third number. In the subtraction series, 3 is subtracted, then 4, then 3, and so on.

Comments

There are no comments.More in Logical Reasoning:

Programming

Copyright ©CuriousTab. All rights reserved.